Get the free cash flow analysis 1084 fillable form

Show details

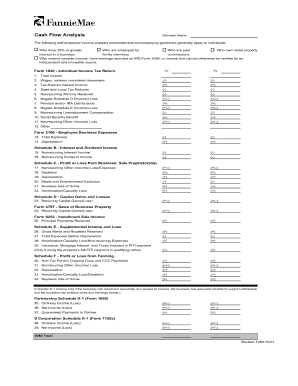

CASH FLOW ANALYSIS FORM 1084 Form 1040 Individual Income Tax Return Line 1 - Total Income Begin with Total Income which represents the borrower s gross income before adjustments. Line 2 Wages Salaries Tips Subtract any income reported on Form 1040 that has been verified and underwritten based on current information or that does not belong to the borrower. This type of income would include salary and hourly compensation income from a spouse or ex-spouse that is not applying for mortgage...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your cash flow analysis 1084 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash flow analysis 1084 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cash flow analysis 1084 fillable online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit cash flow analysis 1084 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out cash flow analysis 1084

How to fill out cash flow analysis 1084?

01

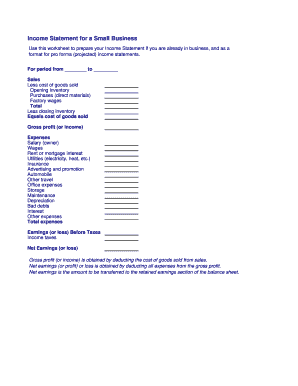

Start by gathering all relevant financial information, including income statements, balance sheets, and cash flow statements for the specified period.

02

Calculate the net cash flow from operating activities by adjusting the net income for non-cash expenses and changes in working capital.

03

Determine the net cash flow from investing activities by analyzing the changes in investment activities, such as acquisitions, disposals, and purchases of long-term assets.

04

Calculate the net cash flow from financing activities by analyzing the changes in borrowing, debt repayments, share issuances, and dividends paid.

05

Add up the net cash flow from all three activities to calculate the overall net cash flow for the period.

06

Summarize the cash flow analysis in the designated spaces on the cash flow analysis 1084 form, ensuring accuracy and attention to detail.

Who needs cash flow analysis 1084?

01

Small business owners who want to assess their company's liquidity and financial stability.

02

Financial analysts who need to evaluate the cash flow performance of a particular company or industry.

03

Lenders or investors who require a comprehensive understanding of an organization's cash flow management before making financing decisions.

Fill flow analysis form : Try Risk Free

People Also Ask about cash flow analysis 1084 fillable

What is the self-employment income?

What is the SAM method of income calculation?

How is self-employment income calculated?

What is the 1084 cash flow analysis form?

What is the self-employment income analysis?

What is Form 91?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cash flow analysis 1084?

Cash flow analysis is a financial process used to assess the amount of cash flowing in and out of a business. It is used to assess the liquidity, solvency, and financial stability of a business. Cash flow analysis can help to identify potential problems in the cash flow of a business and provide solutions to them. It can also be used to make decisions about how to best allocate resources for maximum profitability. Cash flow analysis also helps to identify sources of income, track expenses, and make predictions about future cash flow.

Who is required to file cash flow analysis 1084?

The Internal Revenue Service (IRS) requires all businesses to file a Form 1084, Corporate Cash Flow Analysis, to report their company's cash flow for the year. This form is used to calculate the company's taxable income and to determine whether a business has enough cash on hand to cover its expenses.

What is the purpose of cash flow analysis 1084?

Cash flow analysis 1084 is a financial statement or a tool used to assess an individual or a company's cash inflows and outflows during a specific period. The purpose of cash flow analysis 1084 is to evaluate the liquidity and financial health of a business or individual by examining the sources and uses of cash. It helps identify whether a business has enough cash to meet its obligations, pay debts, and finance its operations. The analysis can also indicate potential cash flow issues or opportunities for improvement in managing cash. Moreover, it aids in making financial decisions, such as investing, budgeting, and planning for future expenses or investments.

What information must be reported on cash flow analysis 1084?

Form 1084, also known as the Cash Flow Analysis form, is used by lenders to document a borrower's income and ability to repay loans. The following information must be reported on this form:

1. Personal Information: The borrower's name, address, Social Security number, and other relevant personal details.

2. Property Information: Details about the property being financed, including the address, type of property, and the purpose of the loan (purchase, refinance, or construction).

3. Income Sources: Documentation of the borrower's income from various sources, including employment, self-employment, rental properties, investments, etc.

4. Employment Income: Detailed information about the borrower's employment, including the employer's name, job title, and length of employment. This section may also include information about any other jobs held by the borrower or the spouse.

5. Self-Employment Income: If the borrower is self-employed, they need to provide detailed financial statements and tax returns to document their income. This includes profit and loss statements, balance sheets, and individual/business tax returns.

6. Rental Income: For rental properties owned by the borrower, they must report the gross rental income, property expenses, depreciation, and net rental income.

7. Other Income Sources: Any additional sources of income, such as interest, dividends, retirement benefits, child support, alimony, etc., need to be documented.

8. Expenses: The borrower's monthly debts and expenses, including credit card payments, car loans, student loans, alimony, child support, and other obligations. The form requires the borrower to list each debt separately, including the creditor's name, outstanding balance, and monthly payment.

9. Evidence of Income and Assets: The borrower needs to submit supporting documentation for all reported income and assets, such as pay stubs, W-2s, tax returns, bank statements, retirement account statements, etc.

10. Certification by Applicant: The borrower must certify that the information provided is true and complete to the best of their knowledge.

It's important to note that specific requirements may vary depending on the lender's guidelines or the type of loan being applied for.

How do I execute cash flow analysis 1084 fillable online?

pdfFiller has made filling out and eSigning cash flow analysis 1084 form easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make edits in cash flow 1084 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your cash flow analysis form 1084, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How can I edit cash analysis form on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing fannie mae 1084 fillable form right away.

Fill out your cash flow analysis 1084 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cash Flow 1084 is not the form you're looking for?Search for another form here.

Keywords relevant to fnma form 1084

Related to cash flow analysis 1084 pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.